HOME >> experience >> Buffalo Restaurant

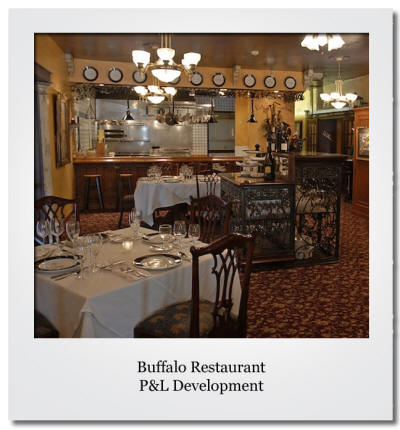

Buffalo Restaurant

I received a telephone call from the owner of a local restaurant asking me if I could look over his operation and determine if there was a better way of handling things from an accounting perspective. I visited the restaurant and reviewed procedures with the owner.

I received a telephone call from the owner of a local restaurant asking me if I could look over his operation and determine if there was a better way of handling things from an accounting perspective. I visited the restaurant and reviewed procedures with the owner.

I reviewed the sales activity for a week to determine whether sales were recorded properly from the information produced from the Micros system. The Bookkeeper maintained an Excel spreadsheet that tracked sales by Breakfast, Lunch, and Dinner. When I reviewed the sales spreadsheet, I noted that an error had been made in compiling sales that could have been caught if the spreadsheet had totaled the sales from each meal period for the day. It was an easy fix to add a check total for each day of the month that would catch similar errors in the future.

I reviewed the method used to calculate Food Cost Percentage and Labor Percentage. While the weekly percentages calculated were correct, I noted that for the year to date percentages, the spreadsheet averaged the percentages for each week of the year, giving each week an equal weight. Since sales and costs can vary significantly from week to week, this process does provide an accurate year to date Food Cost % or Labor Cost %. My recommendation to correct this problem resulted in calculating accurate year to date Food Cost and Labor Cost percentages.

My review of operating costs revealed that some large purchases had been misclassified and the owner was receiving misleading information. When I pointed out these misclassifications to the owner, he reclassed them into the correct accounts, thus providing a different picture of the operation.

The restaurant had a Dinner/Movie Package for Two. However, the price of the package had not changed for several years. My calculations revealed that for every package sold, the restaurant was losing $4. This loss was due to an increase in the price of the movies tickets without a corresponding increase in the package price. My recommendation was to increase the price of the package to cover the increase in the movie tickets, and to review the cost of the movie tickets quarterly to ensure any increase in ticket prices results in an adjustment to the package price.

The owner did not produce a monthly Profit and Loss Statement. Basically, if he had enough cash to pay his bills and pay himself a decent salary, he was happy. I pointed out to him that he had all the information needed to put together a monthly Profit and Loss Statement. He recorded and monitored revenues and product costs through Excel spreadsheets. He could print reports in Quick Books that listed all expenditures for the month. With a few calculations for employee taxes and benefits, depreciation, and income taxes, he had all information available to produce a Profit and Loss Statement. I designed an Excel spreadsheet that would accomplish this goal. It had separate columns for Current Month, Last Year, Current Year to Date, and Last Year’s Year to Date, and percentages of revenues for each component of the P&L. Each month, the owner dropped in the numbers for the current month and prior year. The Year to Date numbers calculated automatically with formulas resident within the spreadsheet.

(RETURN)